The term concentration risk refers to a risk that can lead to a large loss of your capital. In this article, we explain what concentration risks are and how you can identify and avoid them.

What does concentration risk mean

Concentration risk refers to an increased default risk that arises from a strong weighting of assets in a specific area. Area can mean many things, for example investments in only one specific asset class (e.g. only stocks, only bonds or only cryptos), in a specific region (e.g. only German stocks) or a specific sector (e.g. only automotive industry stocks). Concentration risks can therefore arise across many dimensions and it is often not so easy to recognize them.

An example:

Concentration Risk Example

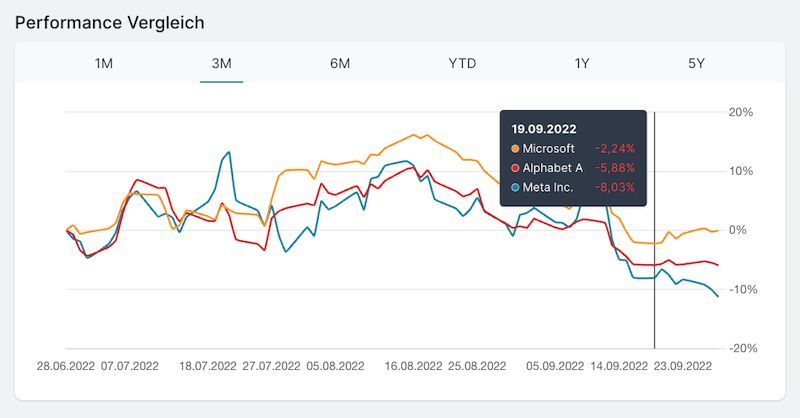

You invest a large part of your wealth in stocks with a focus on the technology sector (e.g. Alphabet (Google), Microsoft, Facebook (Meta)). The stock prices of these companies have a comparatively high correlation, as all three companies are based in the USA, (partially) depend on the advertising market and generate their revenues in the technology sector.

If, for example, the advertising market in the USA collapses, you are very strongly affected as the price drops for all three companies.

Recognizing and avoiding concentration risks

Since concentration risks arise from too strong a concentration on one area, you can avoid the risk by diversifying your portfolio. Diversification here means, for example, that you spread your wealth across different asset classes such as stocks, ETFs and crypto. To avoid concentration risk, investors rely on healthy diversification by market segment, industry, geography and asset classes. Through broader risk diversification, you reduce the probability of complete default. If we stick with the above example of strong concentration on the technology sector, you could sleep much more peacefully with a portfolio that consists of perhaps only 5-10% technology stocks than with one that is 50% invested in tech stocks when this sector is going through a crisis.

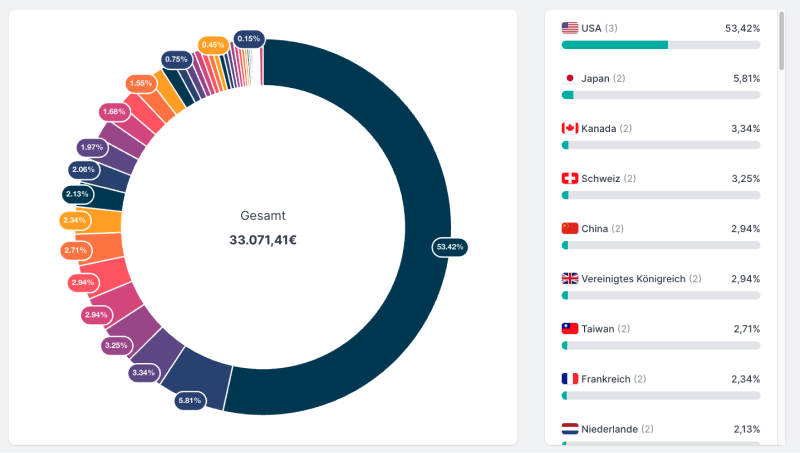

With the Parqet Portfolio Tracker your portfolio is automatically analyzed for various concentration risks. Using various charts and diagrams, you can see, for example, your current allocation in different asset classes, sectors, industries, regions and countries.

New to Parqet?

With Parqet, we work every day to remove the barriers to wealth building. To do this, we build tools that allow you to keep track of your portfolio without much effort, whether at home or on the go.

See how Parqet can simplify your wealth planning, or create your free portfolio in just a few seconds.

Create Portfolio