It's the dream of many investors: Living off the returns from the capital market.

It's the dream of many investors: Living off the returns from the capital market.

In this context, the term dividend strategy keeps coming up.

In this post, we explore what a dividend strategy is, how sensible it is, and what a DAX dividend portfolio or ETF dividend portfolio might look like.

Contents

- 1. What Is a Dividend Strategy?

- 2. Is a Dividend Strategy Sensible?

- 3. How Parqet Supports You in Your Dividend Strategy

- Dividend Dashboard with Personal Dividend Yield

- Dividend Calendar with Access to More Than 35,000 Dividend Securities

- Dividend Preview for Upcoming Dividends

- Comparison of Dividend ETFs with More Broadly Diversified ETFs

- Watch Interesting Dividend Securities in Your Watchlist

- More Dividend Features in Development

- New to Parqet?

1. What Is a Dividend Strategy?

A dividend strategy is an investment strategy where an investor specifically invests in companies with a solid dividend.

A dividend strategy is an investment strategy where an investor specifically invests in companies with a solid dividend.

Pay Attention to Dividend Yield

One of the various dividend metrics considered here is the dividend yield. We've explained in detail how to calculate dividend yield in the blog post on dividend yield (incl. calculator).

The amount of a dividend is determined by the company itself, which leads to significant differences between companies. While some companies pay no dividend (e.g., Tesla and Amazon), other companies have been paying dividends for many years (e.g., Unilever, Johnson & Johnson).

Warning: Dividend Yield Is Not Guaranteed

As with everything else in the world of the stock market: There is no guarantee for a specific dividend yield.

Even if a company has always paid a dividend in the past, this doesn't mean that a distribution will take place in the future. Dividends cannot be called certain.

An example of this is General Electric, whose dividend yield has dropped significantly since 2017. While the dividend yield was around 2% for decades, the current dividend yield is below 0.5%.

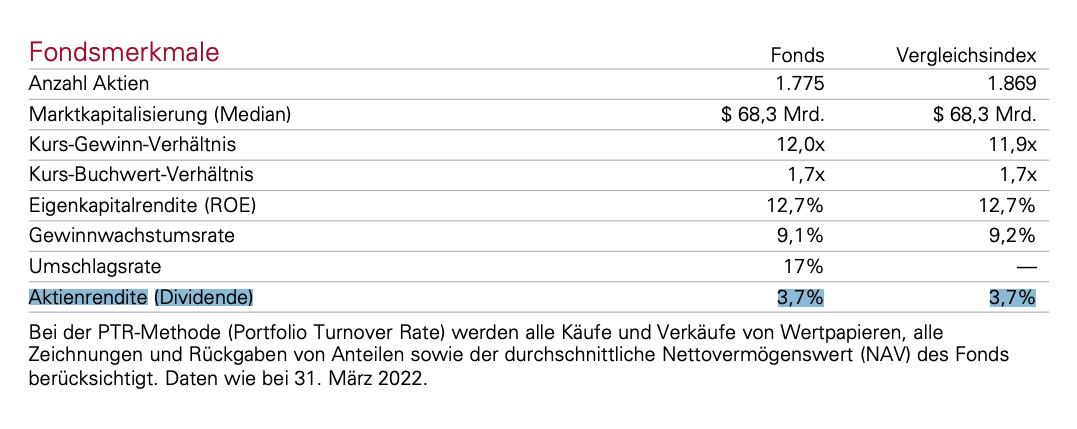

Nevertheless, looking at historical dividend yield can be an indicator of future dividends. For distributing ETFs, the dividend yield of recent months or years can be transparently viewed in the ETF's fact sheet.

Dividend Strategy: Distribution Frequency and Timing

In addition to dividend yield, distribution frequency and timing also play a role in dividend strategy.

Most German corporations distribute their dividends once a year. In contrast, many American companies, as well as some ETFs, distribute their dividends quarterly.

Depending on the individual goals of a dividend strategy, these factors should be considered.

Implementing a Dividend Strategy with Individual Stocks

One way to implement the dividend strategy for yourself is to invest in individual stocks with a high dividend yield. Specifically, this means you select companies from which you expect a high dividend yield.

Note that dividend yield alone is not meaningful, and a very high number can also be a warning sign.

In addition to dividend yield, factors such as dividend history, i.e., the period over which a dividend has been continuously paid, may also be relevant to you.

A first starting point can be searching for so-called dividend aristocrats. Dividend aristocrats, according to the American definition, are companies that have continuously increased their dividend for over 25 years.

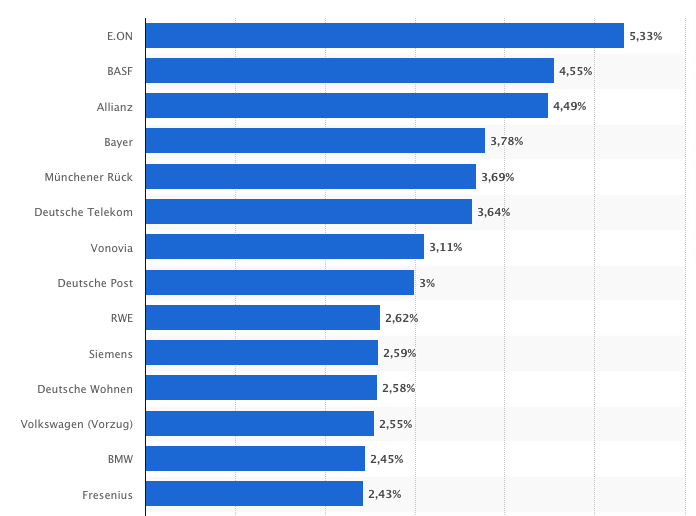

DAX Companies with High Dividend Yield

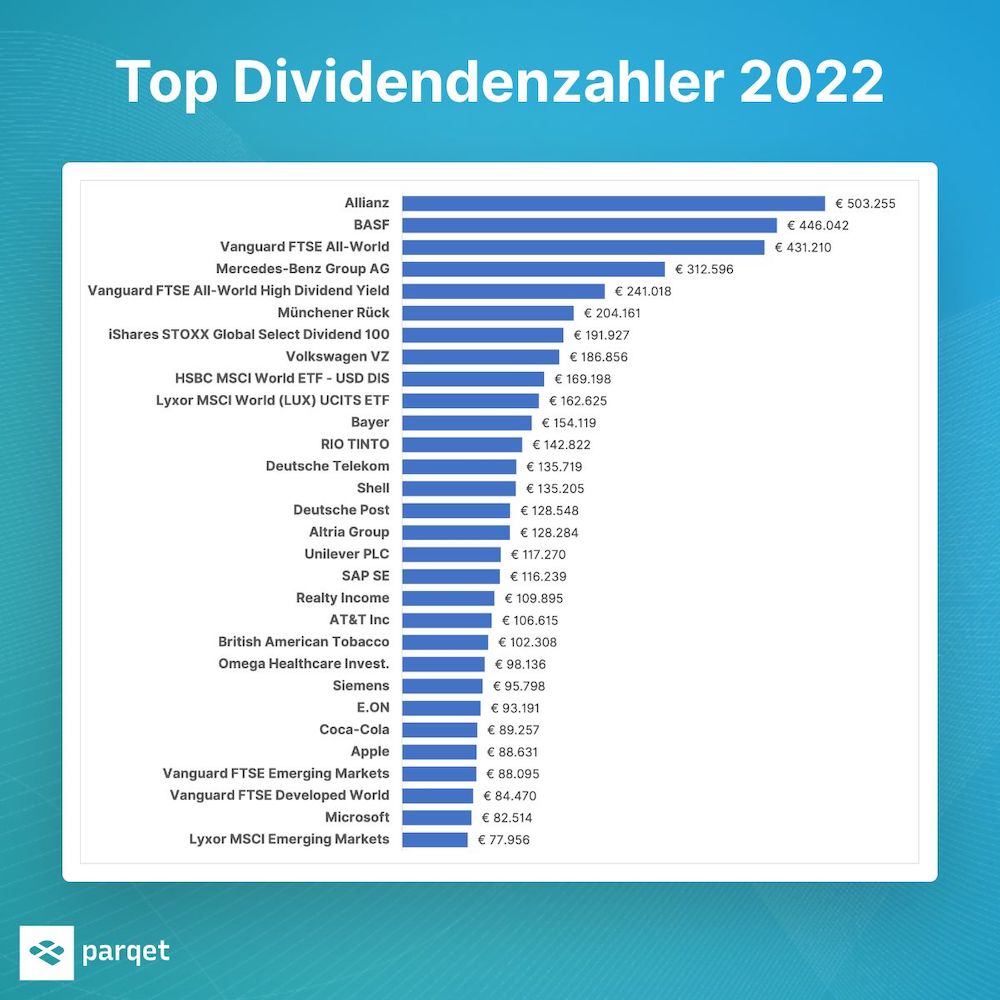

We've created a DAX sample portfolio for you, in which we've added some of the most popular dividend payers.

DAX Dividend Strategy PortfolioDividend Strategy with ETFs

In addition to individual stocks, there are also numerous distributing ETFs. As is typical for ETFs, these bundle a number of stocks into a single product.

For dividend ETFs, these are typically companies from which a high dividend yield is expected.

The advantage over investing in individual stocks is (as with ETFs in general) that the broad diversification reduces the risk of total loss.

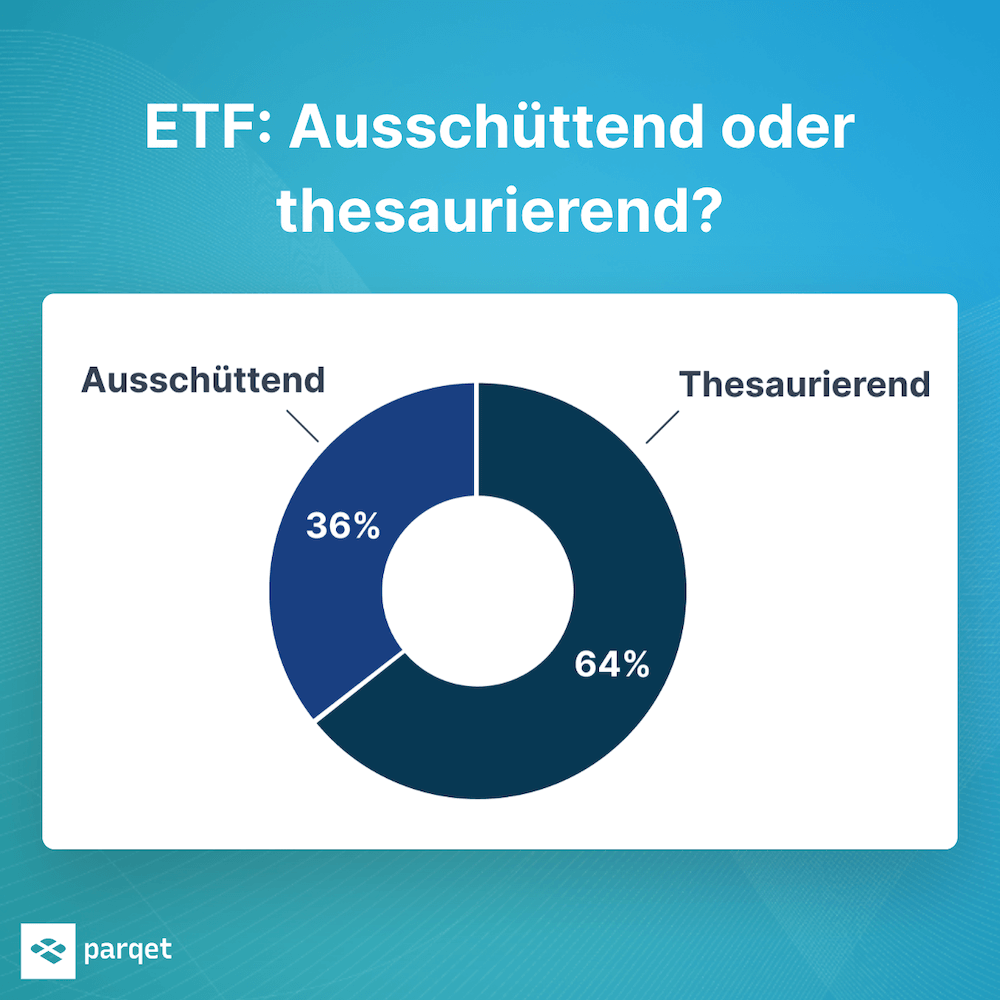

In the Parqet community, distributing ETFs make up about 1/3 of all ETFs.

Among the most popular distributing ETFs are the following:

ETF Dividend Strategy Sample Portfolio

We've added the most popular ETF dividend securities to an ETF sample portfolio, so you can always see the current dividend yield of individual securities.

2. Is a Dividend Strategy Sensible?

Whether a dividend strategy makes sense depends on the individual investor's investment goals. Like any other investment strategy, the dividend strategy has advantages and disadvantages, which we summarize here:

Advantages of a Dividend Strategy

- Dividends can be an indicator of healthy companies: If a company has consistently distributed dividends over the last decades (including crashes and crises), this indicates that the company is in a stable position. The dividend can thus be seen as a "quality mark" for the company's financial stability.

- Emotional factor with dividends: As with dividends in general, individual perception plays a special role in dividend strategy: Many investors are invested in the stock market long-term. The regular distributions in a dividend strategy are a kind of reward that, depending on personality, makes it easier to continuously invest in the stock market.

Disadvantages of a Dividend Strategy

- The compound interest effect is not fully utilized: By immediately distributing the dividend to your account, the money is not automatically reinvested. With long-term investing, you benefit less from the compound interest effect. You can counteract this effect by either (1) using the dividend to immediately buy new shares of the company or (2) generally investing in accumulating ETFs. With these, distributions are automatically reinvested. You don't receive a payment to your account but also don't have to worry about reinvesting.

- The dividend discount reduces the stock price: The distribution of dividends reduces the stock price. The amount of the dividend is deducted from the stock price. This is called the dividend discount.

- A dividend strategy usually involves stock picking: A pure focus on companies with solid dividend metrics means, conversely, that companies with low dividend rates receive less attention. Many companies that tend to pay little or no dividend (e.g., Tesla, Amazon) have grown above average in recent years.

3. How Parqet Supports You in Your Dividend Strategy

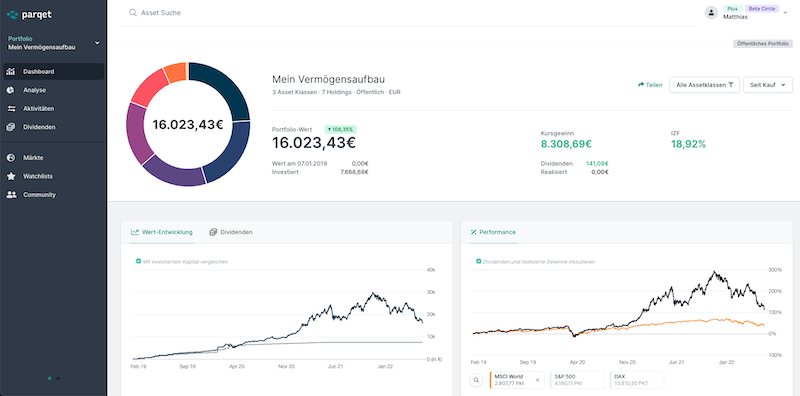

At Parqet, our goal is to lower the barriers to wealth building. With Parqet, you can add your securities and other investments and analyze your portfolio's performance.

At Parqet, our goal is to lower the barriers to wealth building. With Parqet, you can add your securities and other investments and analyze your portfolio's performance.

Since dividends are an important component of wealth building for many investors, Parqet contains many dividend features that support you in your dividend strategy.

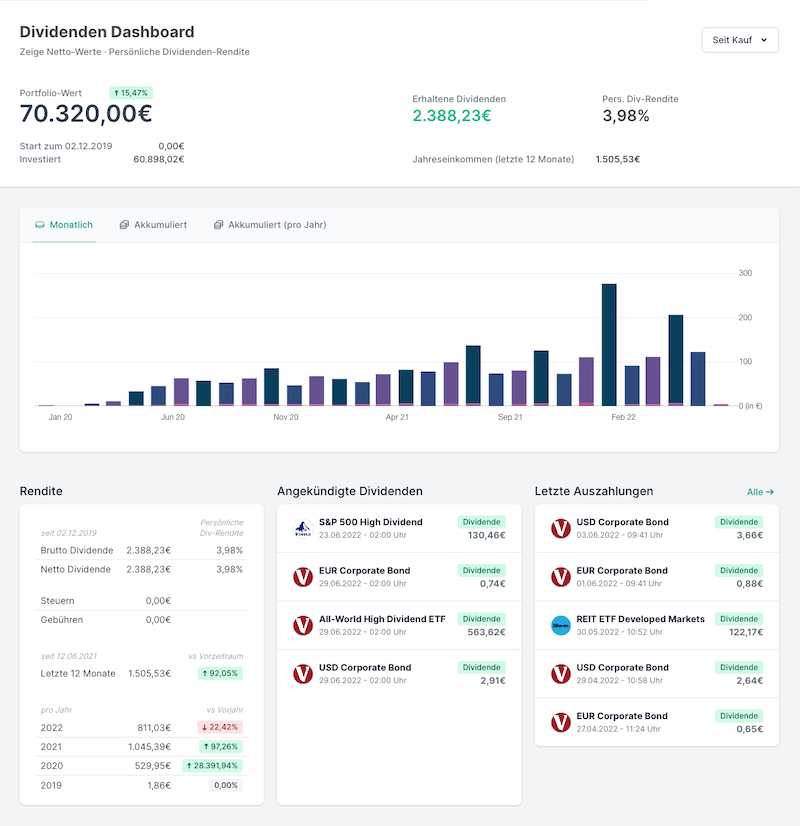

Dividend Dashboard with Personal Dividend Yield

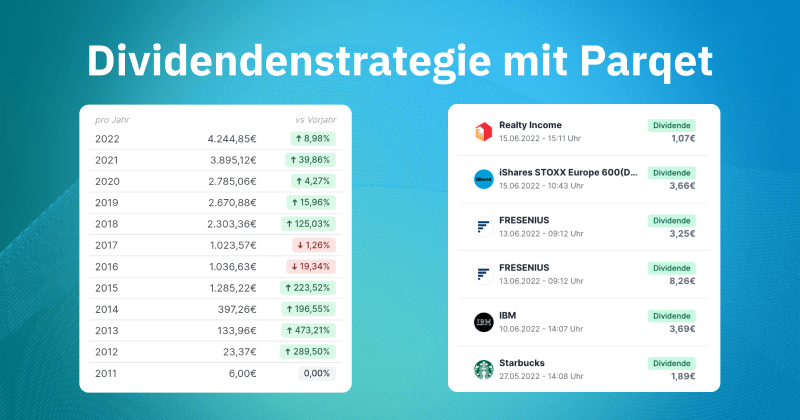

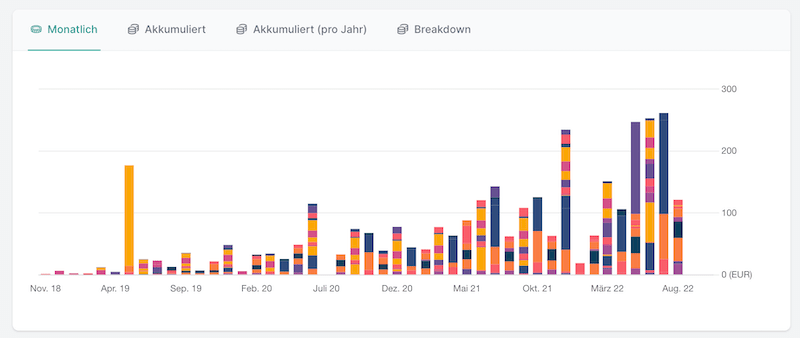

In the Parqet dividend dashboard, you get an overview of all your dividend activities. In addition to a summary of your overall portfolio performance, you'll find deeper details about your dividend performance, such as your personal dividend yield, or information about taxes paid.

With the help of various charts, you can also see at a glance how your distributions have developed over time and whether your dividend strategy is bearing the expected fruit.

Dividend Calendar with Access to More Than 35,000 Dividend Securities

With the Parqet Dividend Calendar, you get access to comprehensive dividend data for more than 35,000 dividend securities. Whether you're an experienced investor or a newcomer to the world of dividend investing, this calendar will help you make informed investment decisions.

Dividend Preview for Upcoming Dividends

One of our users' most popular features is the preview for upcoming dividends. As soon as a dividend is announced for one of your securities, it appears under "announced dividends" in the dividend dashboard (subscription feature).

The forecast is based exactly on the stocks in your own portfolio. So you can see at a glance how many distributions are coming up for you in the next few weeks.

Comparison of Dividend ETFs with More Broadly Diversified ETFs

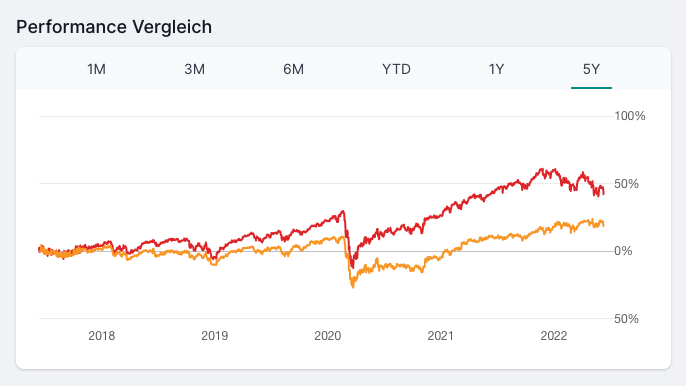

As explained above, a disadvantage of distributing funds is that potentially high-growth companies are not invested in. With Parqet, you can directly compare the performance of different securities. Looking at the performance of a dividend ETF (orange in the screenshot) with a comparable, broadly diversified ETF (red in the screenshot) in the Parqet performance comparison, you can clearly see how the performance of the two ETFs has differed in recent years.

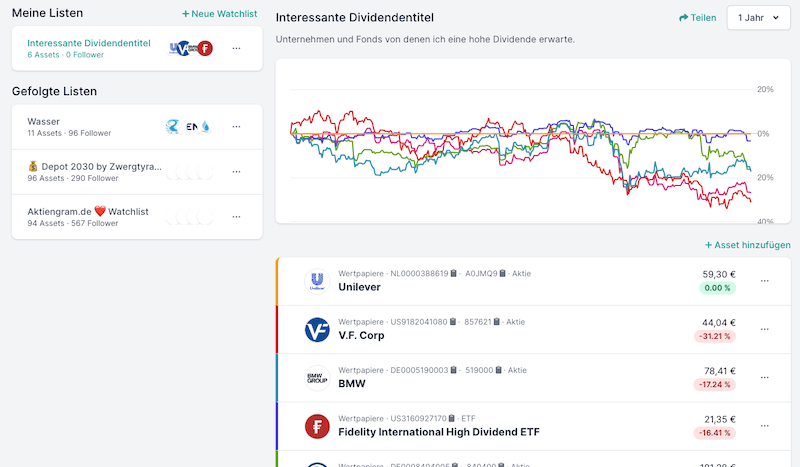

Watch Interesting Dividend Securities in Your Watchlist

When researching interesting dividend securities, things can quickly become confusing. To keep track of interesting companies, you can add securities to a watchlist. In addition to quick access to the various detail pages of the companies, you can also see the performance of the companies in comparison.

More Dividend Features in Development

Since Parqet is constantly being developed, you can expect more dividend features in the future. Which features we develop also depends significantly on the Parqet community. If you want a specific (dividend) feature for Parqet, you can vote for it or suggest it in our feedback tool.

New to Parqet?

At Parqet, we work every day to remove barriers to wealth building. We build tools that allow you to keep track of your portfolio effortlessly, whether at home or on the go.

See how Parqet can simplify your wealth planning, or create your free portfolio in seconds.

Create Portfolio