In our article on dividend strategy, we showed that dividend yield plays an important role in selecting dividend securities.

In this article, we take a closer look at dividend yield and how you can calculate it. We also explain how you can display your personal dividend yield.

What Is Dividend Yield

The dividend yield shows the ratio of a dividend's amount to the current stock price of a company. With a constant stock price, a higher dividend automatically means a higher dividend yield.

How to Calculate Dividend Yield

Dividend yield is determined by two variables:

- Amount of the dividend

- Current stock price

To calculate dividend yield, the dividend is divided by the stock price and multiplied by 100.

Dividend Yield (%) = Dividend Paid ÷ Stock Price × 100

Example Calculation

A company has a stock price of 100 euros and distributes two euros annually as a dividend. The dividend yield is therefore 2%.€2 (Dividend) ÷ €100 (Stock Price) × 100 = 2% Dividend Yield

Since dividend yield is tied to the stock price, it fluctuates daily. If a company's stock price rises while the dividend remains the same, the dividend yield decreases.

Example Calculation with Rising Price

The company's stock price rises from 100 euros to 110 euros. The annual distribution remains at two euros. Due to the increased stock price, the dividend yield drops from 2% to 1.82%.€2 (Dividend) ÷ €110 (Stock Price) × 100 = 1.82% Dividend Yield

With our dividend calculator, you can easily calculate dividend yield:

Dividend Yield Calculator

Wie hoch ist Aktienkurs des Unternehmens?

Wie hoch ist die jährliche Dividende?

Your Personal Dividend Yield

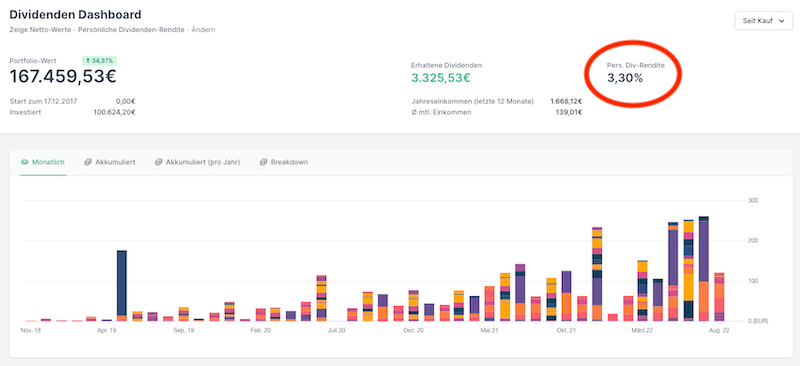

In addition to a company's dividend yield, there's also your own personal dividend yield. The personal dividend yield relates your received dividends to your personal entry price, or purchase price.

An example: You buy a stock worth 50 euros with a dividend yield of 5%. You receive 2.50 euros as a dividend in the first year (5% of 50 euros). In the second year, the price rises by 50% to 75 euros per share. With a constant dividend yield of 5%, you receive 3.75 euros (5% of 75 euros). However, based on your original investment of 50 euros, your personal yield is higher, namely 7.5% (3.75 euros of 50 euros).

With Parqet's portfolio tracking, we automatically calculate your personal dividend yield. You can find this in your dividend dashboard:

New to Parqet?

At Parqet, we work every day to remove barriers to wealth building. We build tools that allow you to keep track of your portfolio effortlessly, whether at home or on the go.

See how Parqet can simplify your wealth planning, or create your free portfolio in seconds.

Create Portfolio