How Industry Classification Works at Parqet

One of the most interesting insights that Parqet offers is certainly the analysis of allocations by industries and sectors of your assets. In this analysis, Parqet examines all assets and shows how your investments are distributed across industries.

Industry classification can be a useful decision-making aid when it comes to diversification. With the help of the classification, it quickly becomes apparent whether an industry or sector in your own portfolio might be significantly overweight, meaning you're taking on higher risk because you strongly favor one industry and would therefore be more affected by a downturn in that industry.

Furthermore, classification enables better comparability of companies with each other. This prevents choosing the wrong peer group when analyzing companies and potentially drawing incorrect conclusions about the company.

Since consistent asset classification is very important and we regularly receive questions about what criteria Parqet uses to classify individual assets, we'll explain the standard used at Parqet and how you can interpret it in this blog post.

Parqet Uses the Global Industry Classification Standard (GICS) from MSCI

At Parqet, we have implemented the Global Industry Classification Standard (GICS) from MSCI. This is a comprehensive industry classification standard developed to classify the industries of publicly traded companies. Here's the key information about MSCI GICS in 2023:

- Structure: The standard consists of 11 sectors, 26 industry groups, 78 industries, and 171 sub-industries. Industry groups can be derived from sectors, industries from industry groups, and sub-industries from industries. The derivation also works in reverse.

- Founding: MSCI GICS was introduced in 1999 and has continuously evolved since then.

- Changes since release: A total of 11 updates have been made, with an update occurring on average every 2 years.

- Stability: MSCI GICS was last updated in March 2023, underscoring its stability and maturity as a standard.

Comparison with Other Standards

There are various industry classification standards on the market, including Vanguard ICB, Morningstar GECS, and Reuters TRBC. Let's take a look at some of these standards and compare them with MSCI GICS:

| Standard | Structure | Founded | Last Update | Average Update |

|---|---|---|---|---|

| Vanguard ICB | 11 Industries, 20 Supersectors, 45 Sectors, 173 Subsectors | 2005 | March 2019 | every 14 years |

| Morningstar GECS | 3 Super-Sectors, 11 Sectors, 69 Industry Groups, 144 Industries | 2010 | 2019 | every 9 years |

| Reuters TRBC | 13 economic sectors, 32 business sectors, 61 industry groups, 153 industries, 895 activities | 2018 | March 2023 | every 2 years |

| MSCI GICS | 11 Sectors, 26 Industry Groups, 78 Industries, 171 Sub-Industries | 1999 | March 2023 | every 2 years |

Why We Use the GICS Standard

Although all standards have their own strengths, there are several reasons why GICS is considered the best standard for portfolio management:

- Currency: The GICS standard is updated on average every 2 years to ensure it always reflects changing market conditions.

- Stability: The fact that MSCI GICS is regularly updated demonstrates its maturity and stability.

- Prevalence: The majority of our community uses products with MSCI reference (about 60%), which facilitates integration and interpretation.

- Transparency: The GICS standard provides a clear and comprehensive classification that allows users to better understand which industry a stock belongs to.

Differences Between Sector and Industry Analysis

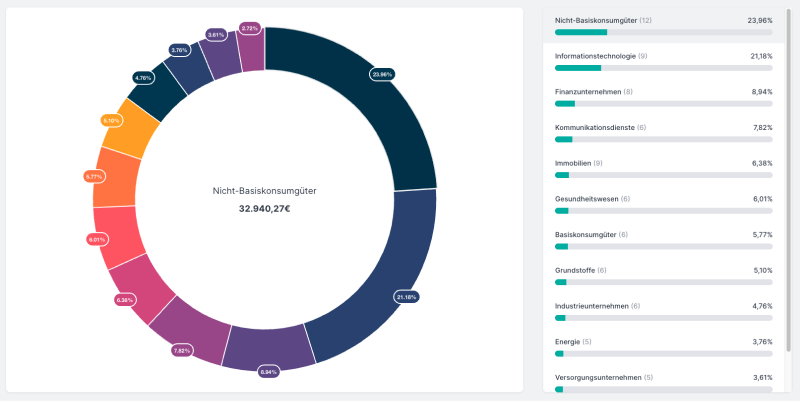

Sector Analysis: The First Step to Transparency

Sectors are at the most abstract level of the GICS standard. Here you can view the sectors of your portfolio simply and clearly. With one click, you can see how large your share of securities in this sector is. But that's not all - our sector analysis considers not only individual stocks but also ETFs! This means you can analyze not only the stocks in your portfolio by sector but also the ETFs that complement your diversification.

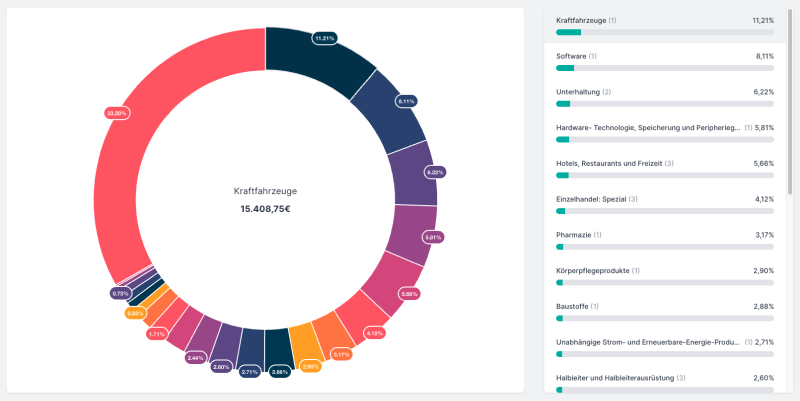

Industry Analysis: More Details, More Information

To gain an even deeper insight into your portfolio, we offer you the option of industry analysis. Here you can see exactly what the individual companies in your portfolio do. Please note that this analysis is only available for individual stocks. ETF providers only communicate industry standards at the sector level.

Precise Classification Made Easy - with Our Analysis Tab

At Parqet, we provide you with an analysis tab that allows you to view all relevant data for classifying your securities.

Based on the GICS standard, you can analyze your portfolios at different levels to better understand your investments, identify risks, and avoid them. This way, you can easily bring structure and logic to your portfolios and always have an overview of how your assets are distributed.

New to Parqet?

At Parqet, we work every day to remove barriers to wealth building. We build tools that allow you to keep track of your portfolio effortlessly, whether at home or on the go.

See how Parqet can simplify your wealth planning, or create your free portfolio in seconds.

Create Portfolio