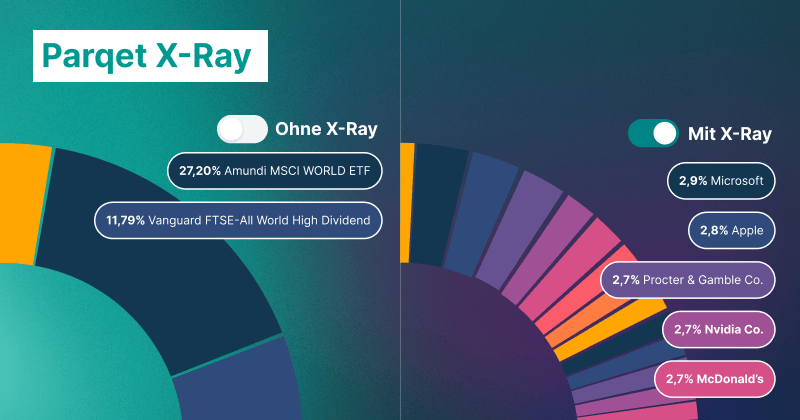

With the latest Parqet update, we've launched one of the most requested features by the community: asset allocation analysis that takes into account the composition of ETFs. We call it Parqet X-Ray.

Parqet X-Ray is now available to all Parqet subscribers and can be activated in the analytics dashboard. In this article, we explain how Parqet X-Ray works in detail.

Identify Concentration Risks with Parqet X-Ray

The asset allocation analysis is one of the most used analysis features of Parqet. With Parqet X-Ray, we now examine your ETFs based on their composition. We then include this composition in the calculation of your asset allocation. This way you can see for the first time how large the share of a particular asset in your portfolio really is.

Example for illustration: You are invested with 80% of your portfolio value in a technology-focused ETF like the Xtrackers MSCI World Information Technology. You have invested the remaining 20% of your portfolio in Apple. Since Apple is also one of the largest positions in the Xtrackers ETF, you are effectively invested "twice". With the new X-Ray function, we show you this overlap - the actual allocation in Apple shares in this example is more than 35%.

By including fund composition in asset allocation, users can now better identify concentration risks and make appropriate adjustments.

Breakdown into Top 100 Assets and Available for More than 4,000 ETFs

To maintain clarity, we've built a limit for the top 100 assets in the first version of Parqet X-Ray. ETFs like the Vanguard FTSE All World, which tracks more than 3,000 companies, have many shares of 0.05% and less. We summarize these small shares in the chart under "Other".

For users who want to dive completely into the data, we additionally offer a CSV export in which all shares are displayed without restriction.

At launch, Parqet X-Ray supports more than 4,000 different ETFs and 100 of the most popular funds. Together with the community, we will gradually expand this support to include the most popular ETFs and also funds.

Parqet X-Ray 2.0

With every new feature we release, we get ideas for extensions and even deeper functions. You're also welcome to actively contribute to the further development of Parqet through our feature voting.

New to Parqet?

With Parqet, we work every day to remove the barriers to wealth building. To do this, we build tools that allow you to keep track of your portfolio without much effort, whether at home or on the go.

See how Parqet can simplify your wealth planning, or create your free portfolio in seconds.

Create Portfolio